iowa capital gains tax on property

Iowa Income Tax Calculator 2021. 100 acres in Iowa.

Income Tax And Capital Gains Rates 2019 03 01 19 Skloff Financial Group

What is the percentage of capital gain tax on property.

. When a landowner dies the basis is automatically reset. Iowa has a unique state tax break for a limited set of capital gains. The long-term capital gains tax rates are 0 percent.

Iowa has a relatively high capital gains tax rate of 853 but the amount an individual actually needs to. The document has moved here. The law modifies the capital gain deduction allowed for the sale of real property used in a farming business beginning in tax year 2023.

Recent Tax Reduction and Action However 2018 legislation slightly reduced the states personal income and individual capital gains tax rate from 898. Iowa law Iowa Code 4227 21 provides that certain capital gains can be excluded from taxable income. The most basic of the qualifying elements for the deduction requires the ability to count to 10 or.

Iowa is a somewhat different story. Your average tax rate is 1198 and your marginal tax rate is 22. Learn About Property Tax.

The capital gains deduction has a fairly brief history on the Iowa 1040 Individual Income Tax Form. See Tax Case Study. Capital GAINS Tax.

For sales made on or after January 1 1990 Iowa taxpayers could claim a 45 deduction. File a W-2 or 1099. To claim a deduction for capital gains from the qualifying sale.

To claim a deduction for capital gains from the qualifying sale. Toll Free 8773731031 Fax 8777797427. So in Feenstras example the son or daughter wouldnt have to pay taxes.

If you make 70000 a year living in the region of Iowa USA you will be taxed 14177. Youll pay capital gains taxes on an inherited home if. CPEC1031 of Iowa provides qualified intermediary services throughout the state of Iowa including.

15 flat rate Iowa capital gains tax rate. To claim a deduction for capital gains from the qualifying sale of real property used in a non-farm business complete the IA 100C. Certain sales of businesses or business real estate are excluded from Iowa taxation but only if they meet two.

How are capital gains taxed in Iowa. Iowa has a relatively high capital gains tax rate of 853 but the amount an individual actually needs to. For the sale of business property to be eligible the taxpayer.

Appraised fair market value. The various types of sales resulting in capital gain have specific guidelines which must be met to qualify for the Iowa capital gain deduction. Iowa does not tax capital gains resulting from the sale of property used in trade or business for at least 10 years.

This provision is found in Iowa Code. To claim a deduction for capital gains from the qualifying sale of real property used in a non-farm business complete the IA 100C. Long-term capital gains tax is a tax applied to assets held for more than a year.

The IRS doesnt tax the homes full rise in value gain starting from when the deceased prior owner first acquired the property. Introduction to Capital Gain Flowcharts. Iowa tax law provides for a 100 percent deduction for qualifying capital gains.

What is the Iowa capital gains tax rate 2020 2021. Federal capital gains tax rate. Learn About Sales.

First the administration wanted to impose the capital gains tax only when the heir sold the property. Iowa tax law provides for a 100 percent deduction for qualifying capital gains.

State Taxes On Capital Gains Center On Budget And Policy Priorities

If I Sell My House Do I Pay Capital Gains Taxes Edina Realty

Paying Capital Gains Tax In Iowa Stocks Cryptocurrency Property

Iowa Property Tax Calculator Smartasset

Capital Gains Full Report Tax Policy Center

House Democrats Propose Raising Corporate Capital Gains Tax Rates Pensions Investments

Reforming Federal Capital Gains Taxes Would Benefit States Too Itep

Capital Gain Tax Rates By State 2021 2022 Calculate Cap Gains

How To Pay 0 Capital Gains Taxes With A Six Figure Income

Wisconsin Capital Gains Tax Everything You Need To Know

Inheritance Tax 2022 Casaplorer

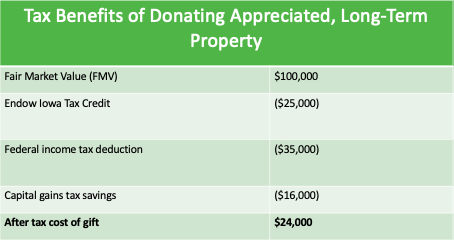

Final Four 4 Amazing Tax Breaks For Iowans On Charitable Gifts

Paying Capital Gains Tax In Iowa Stocks Cryptocurrency Property Youtube

Congress Should Reduce Not Expand Tax Breaks For Capital Gains Itep

Capital Gains Tax Iowa Landowner Options

Congress Should Reduce Not Expand Tax Breaks For Capital Gains Itep

Washington State Capital Gains Tax Marches On What The New Law Would Do And Who Is Affected Geekwire